(Dial 2-1-1 for local help.)

We are pleased to offer you 3 different options for accessing our Guide to Health Insurance...

A complete Guide to Health Insurance, as a downloadable PDF, displayed as one running document with page numbers. This version is your best option if your intention is to read or share the document in its entirety.

A complete Guide to Health Insurance, as a downloadable PDF, displayed without page numbers. This version was designed with the intention that any given page could be printed or shared as a stand-alone resource; in other words, it's your best option if you'd like to share only a part of the guide.

A complete Guide to Health Insurance, on the web! All you have to do to access this version is keep reading below. The entire contents of the Guide to Health Insurance are represented on this web page.

There are many new changes in healthcare...

More people have chances to get health insurance. More people will have access to good healthcare.

We are the Healthy Cleveland Initiative. We want to improve the quality of life for all Clevelanders. We made this guide to help you get and stay healthy. This guide will help you:

Learn how health insurance can improve your life

Understand health insurance terms, processes and resources

Use what you learn to support and maintain your health

Take a few minutes. Read the guide. Each part answers questions you may have.

You are not alone. Many people have questions about healthcare. We are here to help. Please call the phone numbers in this guide for help. Visit the websites to learn more.

Your health matters. A healthier you makes a healthier Cleveland!

Health insurance helps you save money.

It helps you pay for your healthcare. Your healthcare is covered when you have health insurance. You and your health insurance company share your costs. You make payments to the health insurance company. You make payments even when you are well. Your insurance company pays most of your medical bills when you get sick or hurt. The health insurance company figures out prices with doctors and hospitals. This keeps costs down. It also offers you a choice of local providers.

Health insurance gives you peace of mind.

Healthcare can cost a lot. Health insurance protects you from costly medical bills. A broken arm without health insurance can cost more than $7,500. A three-day hospital stay without health insurance can cost more than $30,000. Treating illness and injury is costly. Many medicines cost a lot.

Not having health insurance can cause problems.

Some people go into debt or lose their homes due to costly medical bills. Other people think going to the doctor costs too much. They do not see a doctor when they should. Sometimes this leads to an illness getting worse. It can even result in death.

It depends on your income and situation. You can get health insurance through these ways:

Your employer (Be sure to check! Not all employers provide insurance.)

Private health insurance through an agent or broker

Need help finding an insurance agent or broker? Contact the Ohio Department of Insurance Consumer Services. Call 1-800-686-1526.

How can I buy health insurance from the Health Insurance Marketplace?

Go online. Go to www.HealthCare.gov. Here you can look at plans and compare them. You can sign up for a qualified health plan. You can learn how much financial help you can get.

Or dial 2-1-1 for local help.

What is the Patient Protection and Affordable Care Act (ACA)?

Also known as "Obama Care"

It is the new healthcare law.

Its purpose is to increase the number of Americans with health insurance.

It began the Health Insurance Marketplace. The Marketplace helps people choose and buy health insurance.

What are 10 Benefits I can get because of the ACA?

Regular doctor visits (primary care)

Emergency room visits

Hospitalizations

Pregnancy, giving birth, and new baby care

Mental healthcare, substance and alcohol abuse treatment

Medicines (prescription drugs)

Treatment to get your body working after being sick or hurt (rehabilitation)

X-rays and other tests

Care to keep you from getting sick (preventive care)

Care for your children, including their dental care

You may have more services covered. It depends on your plan. Learn more by contacting your insurance plan.

What is a Qualified Health Plan?

It is a health insurance plan you can get through the Marketplace. Learn more about new health plan options:

Visit HealthCare.gov.

Dial 2-1-1 for United Way's Health Program Information Line. They can help you review your options. They can connect you to local Assisters who can help you choose and apply for a qualified health plan.

You will receive a card or other document after you enroll.

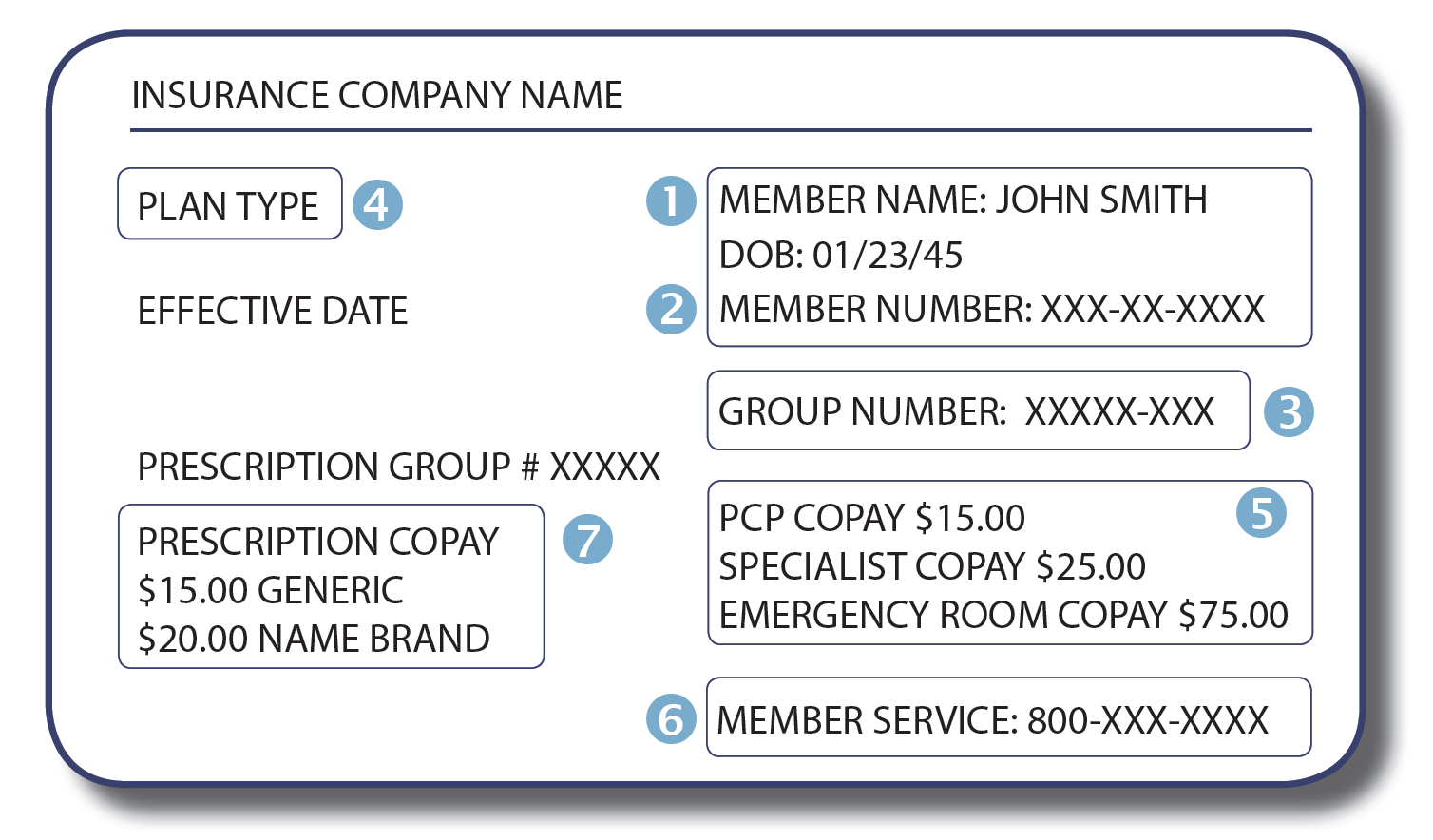

Your insurance card is proof you have insurance. You need to bring this card with you when you receive healthcare. You will also need it when you call your insurance company to ask a question. Your insurance card might look like this:

Your name and date of birth are printed on the card.

Member number: Your unique number helps your provider know how to bill your insurance plan.

Group number: This number tracks the benefits of your plan. It also helps your provider know how to bill your insurance plan.

Plan type: Your card might have a label like HMO or PPO. This tells you what type of insurance plan you have. It also tells you what network your plan has.

Copayment: The amount you pay at the time you receive certain healthcare services.

Phone numbers: You can call your plan with questions. You can call to ask about your coverage. You can also call to find out which healthcare provider is in your network. Phone numbers are sometimes listed on the back of your card.

Prescription copayment: The amount you pay for each prescription you fill.

How much do I pay for health insurance?

It depends on the plan you choose. It also depends on how much medical care you need over a year.

What are the payments I will make over a year?

Payments you make for your insurance and health care services are called out-of-pocket costs. These are the types of out-of-pocket costs you have to pay:

Premium

A fixed amount of money you must pay monthly for your health insurance. Paying your premium protects you from high medical bills. It also means you get help paying your healthcare costs. Premiums are billed monthly. Do not forget to pay your premium. You may lose coverage if you do not pay. Then you may not be able to get coverage again until Open Enrollment. Open Enrollment is each winter.

Deductible

An amount you pay for certain services before your insurance starts to pay. The amount must be paid in total before insurance starts. Your insurance pays for most healthcare costs that year after you pay your deductible.

Example: Your deductible is $1,000. Your plan will not pay for care until you have paid $1,000 in medical costs. The deductible may not apply to all types of services.

Co-pay

A fixed amount of money you pay at the time you receive certain medical services. This cost is not part of your monthly premium.

Example: You might pay $10 or $20 for a doctor’s visit, lab test, or prescription. Co-pays depend on your plan and the type of visit or service. Co-pays are often between $10 and $50.

Co-insurance

Your share of the costs for some covered healthcare services. This starts after you pay the deductible. The amount you have to pay is a percent. It is a percent of the cost of the medical bill. It is not a fixed amount. You will pay more for services that cost more. You will pay less for services that cost less.

Example: Your plan’s allowed amount for an office visit is $100. You met your deductible. Your co-insurance is 20%. Your co-insurance payment would be $20. The plan pays for the rest of the allowed amount.

Out-of-pocket maximum

The most you will pay during a plan period before your plan pays 100%. A plan period is usually a year. This includes co-pays, deductibles and co-insurance. These are called out-of-pocket costs or cost sharing. It does not include your premiums or some out-of-network expenses.

Example: Your out-of-pocket maximum may be $6,600. If you have a bill for $10,000, you only have to pay up to $6,600.

Note: These types of payments depend on the kind of plan you have. Learn more. Contact your insurance plan.

How can I get help paying for my insurance?

There are two types of financial aid if you buy through the Marketplace. They include:

1. Premium Tax Credit:

This is funded by the Federal Government. It helps people lower the cost of health insurance. You can apply the credit to your monthly insurance premium bill. Or take the credit when you do your taxes. It is based on your income and family size.

2. Cost Sharing Assistance:

This reduces the maximum out-of-pocket cost you pay for your plan. Some people may get more help with other cost-sharing amounts. These amounts include deductibles, coinsurance, or co-payments.

How do I qualify for the Premium Tax Credit?

You must make between 100% and 400% of the Federal Poverty Level.

You must not be offered health insurance through your job, unless:

The Marketplace decides you are not able to afford the insurance through your job.

The Marketplace decides the insurance through your job does not meet minimum standards for coverage.

You do not qualify for public health insurance programs. These are programs like Medicaid, Medicare, CHIP or Veterans’/TRICARE benefits.

You are not in prison.

You must buy your health insurance through the Marketplace.

You are a US citizen or legal resident.

Only your own situation matters. Your spouse’s legal status does not matter.

Need help with Medicare Costs?

Learn about the Medicare Savings Program.

Call the Ohio Senior Health Insurance Information Program at 1-800-686-1578.

Go online. Go to insurance.ohio.gov.

What are Managed Care Plans?

Managed care plans are a type of health insurance. They contract with healthcare providers and medical facilities to provide care at reduced costs. These providers make up the plan’s network. The amount of care these plans pay for depends on the network’s rules.

What are Managed Care Networks?

They are contracts with:

doctors

hospitals

clinics

labs

pharmacies

other healthcare providers

Some plans require you receive all healthcare services from a network provider. Other plans allow you to receive care from providers not in the network. You will pay more money for providers not in network.

What are the types of Managed Care Plans?

Plans that restrict your choices often cost less. Plans that offer more choices will cost more.

Health Maintenance Organizations (HMO)

A type of plan. It offers healthcare services only with HMO providers. An HMO usually pays for care only within the HMO network. You might have to choose a primary care doctor. This doctor will be your main healthcare provider. They will refer you to other HMO providers when needed.

Preferred Provider Organizations (PPO)

A type of plan. It contracts with medical providers to create a network. The network includes providers like hospitals and doctors. You pay less if you use providers in the plan’s network. A PPO will pay part of your healthcare costs if you go outside the network. You will have to pay more for care outside of the network.

Point of Service (POS) Plan

A type of plan. It lets you choose between a PPO or HMO each time you need care. You pick a primary care doctor from a list of network providers. Your care is managed by this doctor. The doctor is your point of service (POS). They will refer you to other in-network providers when needed.

Prescription Medications

Most plans have a list of drugs that they pay for. The list is called a formulary.

Your copay for a prescription drug depends on your plan. Some plans prefer generic drugs. Some plans prefer certain brand name drugs.

Example: You take medicine to control your cholesterol level. Your copay may be:

$10 for the generic drug (simvastatin)

$25 for the preferred brand name drug (Lipitor)

$40 for the non-preferred brand name drug (Crestor)

Your copay may be lower if you:

use your insurer’s Preferred Network Pharmacy

use your insurer’s mail order pharmacy

avoid Network or Non-Network retail pharmacies

Have questions about prescriptions? Contact your insurance plan.

Learn more about prescription assistance programs. Dial 2-1-1.

What is Medicare?

Medicare is a federal health insurance program. It is for:

people who are 65 or older

certain younger people with disabilities

people with End-Stage Renal Disease (kidney disease)

people with ALS (Lou Gehrig’s Disease)

There are four parts of Medicare:

Part A covers:

inpatient hospital stays

care in a skilled nursing facility

hospice care

some home health care

Part B covers:

certain doctors’ services

outpatient care

medical supplies

preventive services (like health screenings)

Part C covers:

combines Parts A and B and sometimes Part D into one health plan

plans offered by private insurance companies that contract with Medicare

plans replace Original Medicare

most offer prescription drug coverage

Part D covers:

prescription drugs

Am I covered if I have Medicare?

If you have:

Medicare Part A: You are covered.

Medicare Part A and B: You are covered.

Medicare Part C: You are covered.

Only Medicare Part B: You are not covered.

Part B does not cover hospital stays.

You can sign up for Medicare during certain times every year.

Part A is free if you or your spouse worked and paid taxes into Medicare for ten years. Ten years is forty quarters.

What if I do not sign up for Part A, B or D?

You will have to pay a fine for every year that you did not sign up.

There are programs that may help you pay for Part B or D.

Learn more.

Call Medicare at 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048.

Go online to www.medicare.gov.

Call the Ohio Senior Health Insurance Information Program: 1-800-686-1578

Go to Medicare Services at www.insurance.ohio.gov.

What is Medicaid?

Medicaid is a health insurance program. It is for eligible low-income people.

What is the Children’s Health Insurance Program (CHIP)?

It is a free or low cost health insurance program. CHIP is under Ohio Medicaid. It is for eligible children and teens under the age of 19. CHIP also covers U.S. citizens and eligible immigrants. CHIP is called Healthy Start in Ohio.

What does Medicaid cover?

Checkups and shots

Regular doctor visits

Hospital care

Dental and eye care

X-rays and other tests

Prescriptions

To get covered:

First, you need to apply.

There are many ways to apply. You can apply online, on the phone, or in person. You may need to provide certain papers and information when you apply.

Apply online. Go to benefits.ohio.gov.

Call the Ohio Medicaid Hotline for help applying online or over the phone. Call 1-800-324-8680.

You can apply in person at your local Cuyahoga County Job and Family Services. Or call for more information at 216-987-7000.

Still need help? Dial 2-1-1 or a local insurance assister in your area.

Then, you can pick a plan. There are five Medicaid plans for Ohioans:

Buckeye Health Plan

Online at www.buckeyehealthplan.com

Call 1-866 246-4358

CareSource

Online at www.caresource.com

Call 216-839-1001

Molina Healthcare

Online at www.molinahealthcare.com

Call 1-800-642-4168

Paramount Advantage

Online at www.paramounthealthcare.com

Call 1-800-462-3589

United Healthcare Community Plan

Online at www.uhccommunityplan.com

Call 1-800-895-2017

How can I find a Provider that accepts my Medicaid or Ohio Healthy Start (CHIP) plan?

Ask your current doctor or pharmacist. See if they accept Medicaid or Healthy Start. You will need to find a new provider if they do not.

Check the state Medicaid website at ohiomh.com.

Call the number on your eligibility letter (also on the back of your enrollment card) for help.

MyCare Ohio is a managed care program.

It is a HMO. It is for people who are 18 and older and receive both Medicare and full Medicaid benefits. It combines your Medicare and Medicaid coverage under one care plan.

MyCare Ohio makes sure that everyone that provides your medical care and home and community-based services works together. Every MyCare member has a care manager to help them to make decisions and receive all of the services that they need.

MyCare Ohio includes the benefits of Medicare and Medicaid programs, such as:

doctor and hospital visits

mental health services

prescription drugs

medical equipment and supplies

long-term care services

nursing facilities

assisted living facilities

home healthcare

transportation to medical appointments

community services like adult day care, homemaking, meals and more

Learn more about Ohio Medicaid, Healthy Start, and MyCare Ohio. Call the Ohio Medicaid Consumer Hotline. Call 1-800-324-8680.

For local help about MyCare Ohio, contact Long Term Care Ombudsman. Call 216-696-2719. Or call 1-800-365-3112.

My provider gave me an Explanation of Benefits. What is it?

The Explanation of Benefits (EOB) shows the total charges for your visit. It shows how much you will pay. It shows how much your health plan will pay. It helps you keep track of how you are using your coverage. It is not a bill. You may still get a bill from the healthcare provider. Here is what an Explanation of Benefits looks like:

The EOB includes your name and insurance ID number. It includes some of the numbers on your insurance card. Your insurance plan’s Customer Service Number may be near the plan’s logo or on the back of the EOB.

Service Description: This tells you the healthcare services you received, like a medical visit or lab tests.

Provider Charges: This is the amount your provider bills for your visit.

Allowed Charges: This is the amount your provider will be reimbursed. This may not be the same as the Provider Charges.

Paid by Insurer: This is the amount your insurance plan will pay to your provider.

Payee: This is the person who will receive any payment for overpaying the claim.

What You Owe (or Patient’s Responsibility): The amount you owe after your insurance plan has paid everything else.

Remark Code: This is a note from the insurance plan that explains more about costs, charges, and paid amounts for your service.

What happens if I have a complaint? What happens if I am denied coverage?

You may be able to appeal or file a complaint if:

you have a problem with your insurance plan

your plan denies:

coverage for a healthcare service, supply, or prescription drug you think should be under your insurance plan

payment for healthcare or a prescription drug you already received

your request to change the amount you must pay for a prescription drug

If you think you were charged for something that should be covered:

Keep the bill

Call the phone number on your insurance card or plan papers

Ask for help

Contact your plan if you have questions about your rights.

For Medicare and Medicaid, contact one of these:

Ohio Senior Health Insurance Information Program (OSHIIP)

Call 1-800-686-1578

Go online to www.insurance.ohio.gov.

Ohio Medicaid Consumer Hotline (for Medicaid and Healthy Start)

Call 1-800-324-8680

Legal Aid Society of Cleveland

Legal Aid Society of Cleveland can help eligible, low-income people. You can call Legal Aid with questions about keeping your Medicaid coverage.

Call 216-687-1900 (Cleveland local)

Or call 1-888-817-3777 (toll-free in Ashtabula, Cuyahoga, Geauga, Lake, and Lorain Counties)

Go online. Visit their website at lasclev.org.

Agent/Broker:

The person who sells you an insurance plan. Your contact person at the insurance company.

Appeal:

An action you can take if you believe you were wrongly denied care or coverage. An appeal asks your insurance provider to review a decision they made.

You can appeal if your plan denies:

coverage for a healthcare service, supply, or prescription drug you think should be covered

payment for healthcare or a prescription drug you already received

your request to change the amount you must pay for a prescription drug

You can also appeal if you are getting coverage and your insurance plan stops paying.

Beneficiary:

The people who receive benefits under health insurance. You are the beneficiary of your plan because you receive services. Your family members are also beneficiaries if the plan covers your family.

Co-insurance:

Your share of the costs of a covered service. Co-insurance begins after you pay your deductible. Co-insurance is a percent. It is not a fixed amount. You will pay more for services that cost more. You will pay less for services that cost less.

Co-pay:

A fixed amount of money you pay at the time you receive certain medical services. It is a separate cost from your premium payment.

Deductible:

An amount you pay for certain services before your insurance starts to pay. The amount must be paid in total before insurance pays. Your insurance pays for most healthcare costs that year after you pay your deductible.

Excluded services:

Healthcare services your health coverage or plan does not pay for.

Explanation of Benefits (EOB):

Shows the total charges after you see a provider or get a service. It is a record of the healthcare you or your family got. It shows how much your provider is charging the insurance plan. It shows how much you and your health plan will pay. It is not a bill.

Formulary:

A list of prescription drugs covered by a health insurance plan. Also called a drug list.

Health Maintenance Organization (HMO):

A type of health insurance plan. It usually only covers care from doctors who work for or contract with the HMO. An HMO usually pays for care only within its network.

Managed Care Plans:

A type of plan. The plan contracts with healthcare providers and facilities to provide care at reduced costs. These providers make up the plan’s network. The amount of care these plans pay for depends on the network’s rules.

Network:

The group of doctors and providers your health insurance company works with. It costs you less when you see a provider in your network. You may have a doctor you like. Be sure to pick a health plan that has your doctor in its network. Also known as in-network.

Out-of-network:

It describes a provider who does not have a contract with your plan to provide services. You will pay more to use them.

Out-of-pocket maximum:

The most you will pay during a plan period before your plan pays 100%. A plan period is usually a year. This includes co-pays, deductibles and co-insurance. These are called out-of-pocket costs or cost sharing.

Point of Service (POS) Plan:

A type of plan. It lets you choose between a PPO or HMO each time you need care. You pick a primary care doctor from a list of network providers. Your care is managed by this doctor. The doctor is your point of service (POS). They will refer you to other in-network providers when needed.

Preferred Provider Organization (PPO):

A type of plan. It contracts with medical providers to create a network. The network includes providers like hospitals and doctors. You pay less if you use providers in the plan’s network. A PPO will pay part of your healthcare costs if you go outside the network. You will have to pay more for care outside of the network.

Premium:

A fixed amount of money you must pay monthly for your health insurance.

We'd like to thank our partners.

On behalf of the City of Cleveland Department of Public Health and the Healthy Cleveland Initiative, we would like to acknowledge our passionate partners who have made this publication possible and help us build a healthier Cleveland every day:

Made possible by:

Further Reading:

Understanding your options for health insurance is only a part of the big picture of understanding your health. Learn more about the role you play in your own health here.